In this post I will explore the world of Payment Services Directives (PSD), where PSD agents are the unsung heroes, diligently working behind the scenes to ensure smooth transactions. If you’ve ever wondered who these mysterious figures are and what role they play in the grand scheme of payment services, you’ve come to the right place.

In this comprehensive guide, I’ll delve into the nitty-gritty of PSD agents’ roles, responsibilities, and their significant influence on the payment services industry.

This guide promises to be as informative as it is engaging, providing expert advice and insights. So, whether you’re a seasoned professional in the industry or a curious novice, there’s something for everyone. Let’s dive in!

1. Exploring the Importance of PSD Agents in the Payment Services Directive

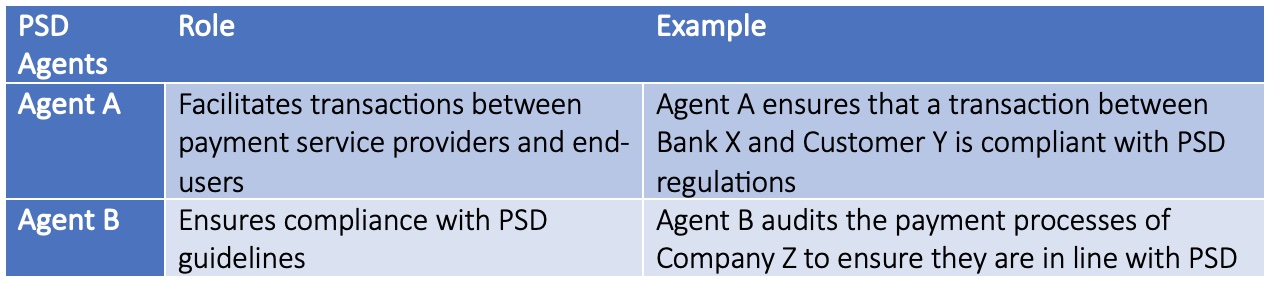

In the complex ecosystem of digital payments, PSD Agents play a pivotal role in facilitating seamless transactions. They serve as intermediaries between the payment service providers and the end-users, ensuring compliance with the Payment Services Directive (PSD). The PSD, a regulatory initiative by the European Union, aims to create a single market for payments across the EU, enhancing competition and innovation in the sector. PSD Agents, therefore, are integral to this vision, as they help in streamlining the payment processes and ensuring that they are in line with the directive’s guidelines.

2. The Function of PSD Agents in Facilitating Payment Services

PSD Agents play a pivotal role in the smooth operation of payment services. They act as intermediaries between the payment service providers and the customers, ensuring that transactions are processed efficiently and securely. PSD Agents are responsible for facilitating communication, managing customer queries, and handling transaction disputes. They also play a crucial role in maintaining compliance with the Payment Services Directive regulations.

- Facilitating communication between the payment service providers and the customers

- Managing customer queries and transaction disputes

- Maintaining compliance with the Payment Services Directive regulations

Moreover, PSD Agents are instrumental in implementing new payment technologies and services. They work closely with payment service providers to integrate innovative payment solutions, such as mobile payments, digital wallets, and contactless payments. This not only enhances the customer experience but also ensures that the payment services are up-to-date with the latest technological advancements. In essence, the role of PSD Agents is crucial in shaping the future of payment services.

3. How PSD Agents Contribute to the Implementation of the Payment Services Directive

With the advent of the Payment Services Directive (PSD), a new era of financial transparency and consumer protection was ushered in. PSD Agents have a pivotal role in ensuring the smooth execution of this directive. They act as intermediaries between the payment service providers and the consumers, facilitating transactions and ensuring compliance with the regulatory framework. Their role is not just limited to transaction facilitation; they also play a significant part in risk management, fraud detection, and maintaining the integrity of the payment ecosystem.

Moreover, PSD Agents are instrumental in promoting the adoption of innovative payment solutions. They work closely with FinTech companies and traditional banks to integrate new technologies into the payment infrastructure. This not only enhances the user experience but also fosters competition in the market, leading to better services and lower costs for consumers. In essence, PSD Agents are the linchpins that hold the PSD framework together, driving its implementation and ensuring its success.

4. The Impact of PSD Agents on the Payment Services Industry

As the payment services industry continues to evolve, the role of PSD Agents has become increasingly significant. These agents, integral to the implementation of the Payment Services Directive, have a profound impact on the industry in several ways.

Firstly, PSD Agents facilitate the seamless integration of new payment technologies into existing financial systems. This not only enhances the efficiency of transactions but also broadens the scope of services available to consumers. Secondly, they ensure compliance with regulatory standards, thereby maintaining the integrity of the payment services industry.

Below are some key areas where the impact of PSD Agents is most felt:

- Regulatory Compliance: PSD Agents ensure that payment service providers adhere to the regulations set forth in the Payment Services Directive. This includes safeguarding consumer rights, promoting transparency, and preventing fraudulent activities.

- Technological Integration: PSD Agents play a pivotal role in integrating new payment technologies into existing financial systems, thereby enhancing efficiency and expanding the range of services available to consumers.

- Market Competition: By facilitating the entry of new players into the market, PSD Agents contribute to healthy competition, which ultimately benefits consumers through improved services and lower costs.

5. The Relationship Between PSD Agents and the Payment Services Directive

Within the framework of the Payment Services Directive (PSD), PSD Agents serve a crucial role. They act as intermediaries between payment service providers and consumers, facilitating transactions and ensuring compliance with the directive’s regulations. The PSD, enacted by the European Union, aims to create a single market for payment services, fostering competition and innovation while ensuring consumer protection. PSD Agents, therefore, are pivotal in achieving these objectives, as they bridge the gap between service providers and consumers, ensuring smooth, secure, and compliant transactions.

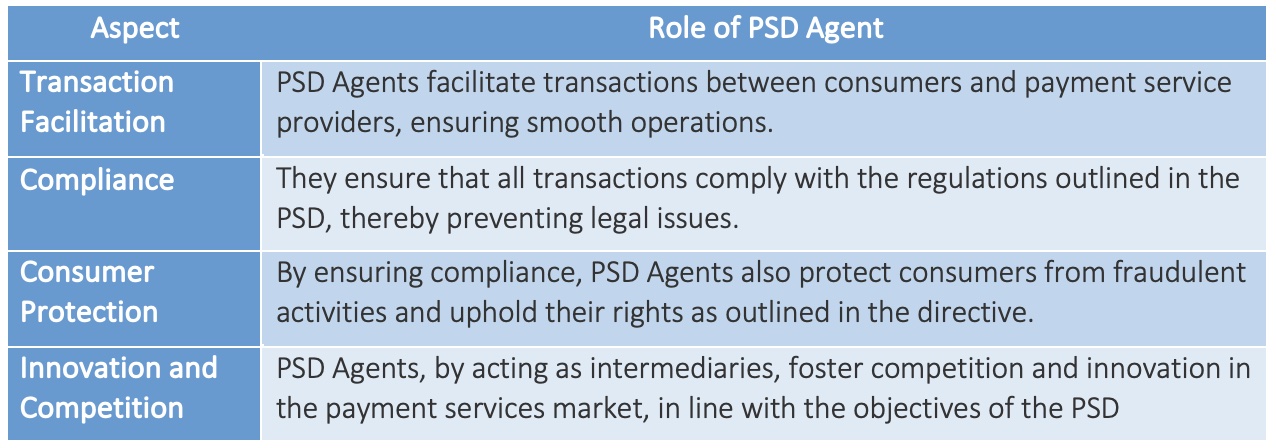

Consider the following comparison table, which illustrates the role of PSD Agents in various aspects of the Payment Services Directive:

In essence, the relationship between PSD Agents and the Payment Services Directive is one of mutual dependence. The PSD provides the regulatory framework within which PSD Agents operate, while the agents ensure the effective implementation of the directive, thereby contributing significantly to the creation of a single, competitive, and innovative market for payment services.

6. Unveiling the Responsibilities of PSD Agents under the Payment Services Directive

Under the Payment Services Directive (PSD), PSD Agents are entrusted with significant responsibilities. They are the intermediaries between payment service providers and consumers, ensuring that transactions are conducted smoothly and securely. Their role is pivotal in maintaining the integrity of the payment services industry. However, their responsibilities are not without challenges. They must navigate the complex regulatory landscape, adhere to stringent compliance requirements, and manage potential risks associated with payment transactions.

One of the primary advantages of PSD Agents is their ability to facilitate seamless payment transactions. They are equipped with the necessary knowledge and skills to handle various payment services, from money remittance to card-based payment transactions. Their expertise contributes to the efficiency and reliability of payment services, which is crucial in today’s digital economy. However, the role of PSD Agents also comes with certain drawbacks. The regulatory burden can be substantial, as they must keep abreast of evolving regulations and ensure compliance at all times. This can be time-consuming and costly, particularly for smaller agents.

Moreover, PSD Agents are responsible for managing potential risks associated with payment transactions. They must implement robust risk management strategies to prevent fraud and other security breaches. This is a critical aspect of their role, as it directly impacts the trust and confidence of consumers in payment services. On the flip side, the need for stringent risk management can also be a disadvantage. It requires significant resources and expertise, which may not be readily available to all agents. Despite these challenges, the role of PSD Agents remains indispensable in the Payment Services Directive, ensuring the smooth operation of the payment services industry.

7. The Influence of PSD Agents on the Evolution of Payment Services

Over the years, the landscape of payment services has undergone significant transformations, largely driven by the role of PSD Agents. These agents, operating under the Payment Services Directive, have been instrumental in shaping the current state of payment services. Their influence is particularly evident in the increased efficiency, security, and convenience of modern payment methods. However, the role of PSD Agents is often undefined, leading to a lack of understanding about their impact on the evolution of payment services.

One of the key ways PSD Agents have influenced the evolution of payment services is through the promotion of innovation. By facilitating the entry of new players into the market, they have stimulated competition and innovation. This has led to the development of more advanced payment technologies and systems, which have in turn improved the overall user experience. Furthermore, PSD Agents have played a crucial role in ensuring that these innovations adhere to the necessary regulatory standards.

Another significant impact of PSD Agents on the evolution of payment services is their role in enhancing consumer protection. They have been instrumental in implementing measures to safeguard consumer rights and interests, such as ensuring transparency in pricing and terms of service. This has not only increased consumer confidence in using digital payment services, but also contributed to the overall growth and development of the payment services sector.

8. Future Prospects for PSD Agents in the Context of the Payment Services Directive

Looking towards the future, the role of PSD agents is expected to evolve significantly. The Payment Services Directive (PSD2) has already begun to reshape the landscape of the payment services industry. PSD agents are now required to adapt to these changes and develop new strategies to remain competitive. This includes embracing technological advancements, enhancing security measures, and improving customer service. However, these changes also present challenges. PSD agents must navigate through complex regulatory requirements, manage potential risks, and invest in necessary infrastructure and training.

On the positive side, the PSD2 opens up new opportunities for PSD agents. The directive encourages innovation and competition in the payment services market. This could lead to the development of new business models and services, providing PSD agents with the chance to expand their offerings and reach new customers. Furthermore, the increased transparency and security measures required by the directive could enhance trust in PSD agents, potentially attracting more clients.

However, there are also potential downsides. The increased competition could put pressure on PSD agents, particularly smaller ones, who may struggle to keep up with the pace of change. The costs associated with implementing the necessary changes could also be significant. Additionally, the directive’s focus on consumer protection means that PSD agents will need to ensure they are fully compliant with all regulations, which could be a complex and time-consuming process.

Frequently Asked Questions

-

What qualifications are required to become a PSD agent?

PSD agents are required to have a deep understanding of the Payment Services Directive and its implementation. They should also have experience in the payment services industry and a strong knowledge of financial regulations. Additionally, they should possess excellent communication and problem-solving skills.

-

How do PSD agents interact with other stakeholders in the payment services industry?

PSD agents play a crucial role in liaising between payment service providers, customers, and regulatory authorities. They ensure that all transactions comply with the Payment Services Directive and work to resolve any issues that may arise during the process.

-

What are the potential challenges faced by PSD agents in implementing the Payment Services Directive?

PSD agents may face challenges such as keeping up with changes in financial regulations, managing the expectations of different stakeholders, and ensuring that all transactions are compliant with the Payment Services Directive. They also need to stay updated on technological advancements in the payment services industry.

-

How have the roles and responsibilities of PSD agents evolved over time?

The roles and responsibilities of PSD agents have evolved significantly with the advancement of technology and changes in financial regulations. They are now more involved in ensuring compliance with the Payment Services Directive, facilitating transactions, and liaising between different stakeholders.

-

What is the future outlook for PSD agents in the payment services industry?

The future outlook for PSD agents is promising, with the increasing reliance on digital payment services. As the industry continues to evolve, PSD agents will play an even more crucial role in ensuring compliance with the Payment Services Directive and facilitating smooth transactions.