In this article, I will take you step-by-step through the process of developing a startup marketing materials that will captivate investors and convey the value proposition of your startup.

My goal is to provide you with valuable insights and best practices to help you succeed in attracting investors and securing funding for your venture.

Eight types of marketing material a start-up needs to attract investors and raise capital.

Contents:

- Crafting a Compelling Business Plan: A Step-by-Step Guide

- Creating an Effective Investor Presentation: Conveying the Value Proposition

- Crafting a Convincing Executive Summary: Summarizing the Startup’s Potential

- Building an Impressive Pitch Deck: Captivating Investors’ Attention

- Developing a Solid Financial Model: Demonstrating Profitability and Growth Potential

- Preparing an Engaging Investor Teaser: Generating Interest and Inquiries

- Developing a Comprehensive Due Diligence Package: Assuring Investors of a Viable Investment Opportunity

- Designing an Attractive Website: Establishing Online Presence and Credibility

Crafting a Compelling Business Plan: A Step-by-Step Guide

As the foundation of your startup, a compelling business plan is critical to attracting potential investors. This document serves as a roadmap for your business, outlining your goals, strategies for achieving them and the timeframe in which you expect to achieve them. It should provide a clear picture of your business model, market analysis, organizational structure, product line or services, marketing and sales strategy, and financial projections. Remember that investors are looking for startups with high growth potential and profitability, so your business plan should demonstrate these aspects convincingly.

When writing your business plan, start by defining your executive summary. This section should be concise yet powerful enough to grab the investor’s attention from the start. It should summarize what your company does, why it will be successful (your unique value proposition), and how it fits into the current market landscape. Next is the company description, which provides detailed information about what problem your startup solves and how it does so uniquely. This is followed by the market analysis section, where you present data on your target audience, the competition, and how you plan to position yourself in the market.

The Organization and Management section outlines your company’s legal structure and management team, while the Service or Product Line section details what you’re selling or providing. Your marketing and sales strategy should then explain how you’ll attract and retain customers. Finally, but most importantly, is the financial projections section, where you need to convince investors that they will get a return on their investment. This includes income statements, balance sheets, cash flow statements and capital expenditure budgets for at least the next three years. Remember that each part of this plan must be carefully researched and well written, as it can make or break an investor’s decision.

Creating an Effective Investor Presentation: Conveying the Value Proposition

After creating a compelling business plan, the next step is to create an effective investor presentation. This is your opportunity to communicate your startup’s value proposition in a clear and engaging way. The investor presentation should be more than just a visual aid; it should tell a story about your company, its mission and how it plans to achieve its goals. It’s important to remember that investors are not only investing in a business idea, but also in the people behind it. Therefore, showcasing your team’s expertise and dedication can greatly enhance your startup’s appeal.

The structure of your investor presentation should be strategic. Start with an attention-grabbing introduction, followed by a presentation of the problem your startup is trying to solve. Then introduce your solution or product and explain how it addresses the identified problem uniquely or more effectively than existing solutions. Highlighting the market size and growth potential can further demonstrate the lucrative opportunity your startup represents. Remember to include financial projections and funding requirements.

Visuals play an important role in the effectiveness of an investor presentation. Use graphs, charts, images and infographics wherever possible to make complex information easily digestible. However, avoid cluttering your slides with too much information; each slide should focus on a key point or message. Practice delivering this presentation until you are smooth and confident – remember that communication skills can greatly influence how investors perceive you and your startup. Finally, always end with a strong call-to-action that encourages investors to take the next step toward investing in your business.

Crafting a Convincing Executive Summary: Summarizing the Startup’s Potential

After you’ve developed a compelling business plan and created an effective investor presentation, the next important step is writing a convincing executive summary. This document serves as a snapshot of your startup’s potential, providing investors with a concise overview of your business model, market opportunity, competitive advantages, and financial projections. It should be succinct yet comprehensive enough to pique their interest and prompt them to delve deeper into your proposal.

The executive summary should start with a strong opening that clearly articulates your value proposition. This could be an innovative solution to a pressing problem, a unique product or service offering, or a disruptive business model that promises high returns. Use data and facts to substantiate your claims and demonstrate market validation. Remember, investors are looking for startups that not only have great ideas but also have the potential for significant growth and profitability.

Next, provide an overview of your target market and competition. Highlight the size of the opportunity and how your startup is uniquely positioned to capture it. Discuss your go-to-market strategy and how you plan to acquire customers cost-effectively. Finally, outline your financial projections for the next three to five years, showing how you intend to achieve profitability and scale. Be sure to include key metrics such as revenue growth rate, gross margin, customer acquisition cost (CAC), lifetime value (LTV) of customers, etc., which are critical indicators of your startup’s performance and potential return on investment (ROI) for investors.

Building an Impressive Pitch Deck: Captivating Investors’ Attention

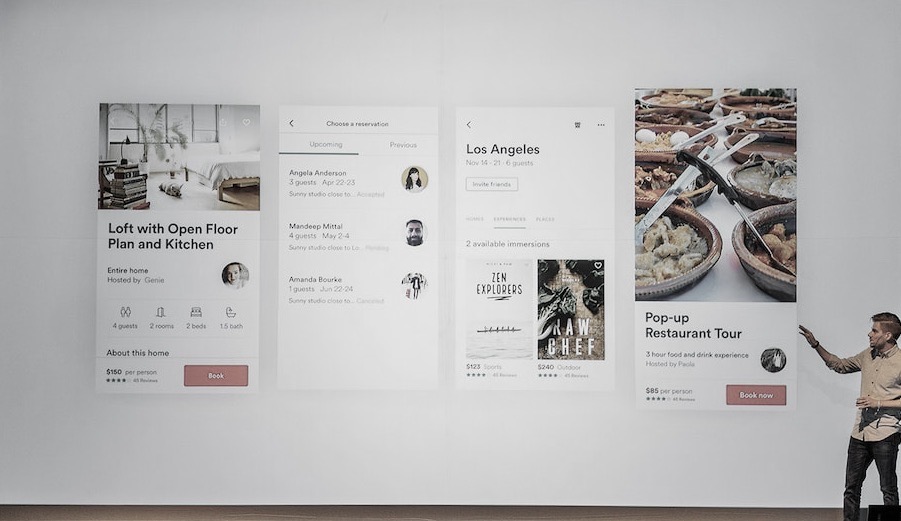

Once you have created a compelling business plan and executive summary, the next crucial step is to create an impressive pitch deck. A pitch deck is a short presentation that gives investors an overview of your business, often using PowerPoint slides. It’s your chance to grab investors’ attention and make them see the potential in your startup. The key is to keep it concise yet comprehensive, covering all aspects of your business without overwhelming the audience.

Your pitch deck should start with a strong introduction. This should clearly communicate what your startup does and why it’s important. This should be followed by details about the market size and opportunity, your product or service, business model, marketing strategy, competitive landscape, financial projections and team. Each slide should be visually appealing and easy to understand at a glance. Remember, investors are busy people who see countless pitches every day – you need to make yours stand out.

While content is king when it comes to pitch decks, design also plays an important role in capturing an investor’s attention. Use high-quality images and graphics to support your points and maintain visual interest throughout the presentation. Avoid cluttering slides with too much text or complex charts; instead, opt for simplicity and clarity. If your budget allows, consider hiring a professional designer who can greatly enhance the overall look and feel of your pitch deck, further increasing its impact on potential investors.

Developing a Solid Financial Model: Demonstrating Profitability and Growth Potential

Developing a solid financial model is the next critical step after creating a compelling business plan and an effective investor presentation. This model serves as a roadmap for your startup’s financial future, demonstrating both profitability and growth potential. It should include detailed projections of revenues, costs and cash flow for the next three to five years. These projections must be realistic yet ambitious. They must show investors that your startup has the potential to generate a significant return on their investment.

The financial model should also include key performance indicators (KPIs) relevant to your industry. These KPIs will help investors understand how your startup compares to others in the same industry. For example, if you’re running a SaaS company, you might include metrics like monthly recurring revenue (MRR) or customer acquisition cost (CAC). Remember, these numbers aren’t just numbers; they tell a story about the health and trajectory of your startup. That’s why it’s important to explain each number clearly and convincingly.

Finally, it is important to be mindful of risk factors in the development of this financial model. Every investment carries some level of risk, and savvy investors will want to know what those risks are before they commit their funds. Be transparent about potential challenges and your mitigation plans. This honesty not only builds trust with investors, but also shows that you have thought through all aspects of your business strategy. A well-crafted financial model can be one of the most persuasive tools in your fundraising arsenal – if you do it right.

Preparing an Engaging Investor Teaser: Generating Interest and Inquiries

Once you have a solid financial model in place, the next step in your fundraising journey is the creation of a compelling investor teaser. This document serves as a snapshot of your startup, giving potential investors a brief overview of your business and its potential for success. It’s important to get them excited and get them to want to learn more. The investor teaser should be concise, compelling and professionally designed to reflect the quality and potential of your startup.

The content of your investor teaser should include key details about your company, such as the problem you’re solving, your unique solution, the size and opportunity of the market, your business model, your competitive advantage, the composition of your team, and any significant milestones or traction you’ve achieved to date. Remember to keep it concise yet informative; aim to convey the most important aspects of your startup in a way that is easy for investors to understand quickly. Use clear language and avoid jargon whenever possible. The goal is not only to inform, but also to intrigue; you want investors to be curious enough about what they see in the teaser to request a full pitch deck or schedule a meeting.

While creating a compelling investor teaser may seem daunting at first, remember that it’s essentially a marketing tool-one that sells not only your product or service, but also your company’s vision and potential. So it’s important that it reflects both the passion you have for what you do and the professionalism with which you approach it. A well-crafted investor teaser can make all the difference in piquing the interest of potential investors and setting the stage for successful fundraising rounds.

Developing a Comprehensive Due Diligence Package: Assuring Investors of a Viable Investment Opportunity

After you have attracted the attention of potential investors with your business plan, pitch deck, and financial models, the next step is to make sure they’re fully vetted. This is an essential step in the fundraising process because it provides investors with a detailed overview of your startup’s operations, financials, legal issues, and more. It serves as a testament to your transparency and commitment to good governance.

The due diligence package should include key documents such as financial statements, contracts, details about your organizational structure, information about your intellectual property rights, and any other relevant documents that can validate the viability of your startup. Remember that this package is not only about showing what you have accomplished so far, but also about demonstrating how well prepared you are for future challenges. Therefore, it should include risk assessments and contingency plans.

Developing a comprehensive due diligence package requires meticulous attention to detail and thoroughness. It may seem like a daunting task, but consider it an opportunity to present your startup in the best possible light. Be proactive in addressing potential concerns or red flags by providing clear explanations or solutions within the package itself. This will not only assure investors of a viable investment opportunity, but also build their confidence in your management abilities.

Designing an Attractive Website: Establishing Online Presence and Credibility

Establishing a strong online presence and credibility is critical as your startup progresses through the fundraising stages. This is where designing an attractive website comes into play. A well-designed website not only showcases your product or service, but also serves as a platform for potential investors to learn more about your business. It should be easy to use, visually appealing, and contain all the necessary information about your startup, including its mission, team, products or services, and contact information.

For both customers and investors, your website should effectively communicate your value proposition. It should highlight the problem you’re solving, how you’re uniquely positioned to solve it, and why you’re better than any existing solution on the market. Remember, investors aren’t just investing in a product or service; they’re investing in a story and a vision. So make sure your website tells that story in a compelling way. Use compelling visuals, engaging content, customer testimonials, case studies, press mentions – anything that helps build trust and credibility.

Finally, don’t forget about SEO (search engine optimization) when designing your website. SEO is essential to improving your site’s visibility on search engines like Google. This means using relevant keywords throughout your site’s content and meta tags, optimizing images with alt text descriptions for both accessibility and SEO benefits, and having a responsive design that works well on mobile devices since many people are browsing the web on their phones these days. Also consider adding a blog section where you can regularly publish fresh content related to your industry or business updates, which can further boost SEO efforts while keeping visitors engaged.